Ecommerce Sales Tax Software simplifies the often-complex world of sales tax compliance for online businesses. Navigating the intricate web of state and local tax regulations can be daunting, but the right software can automate calculations, filing, and reporting, saving businesses valuable time and resources. This allows e-commerce entrepreneurs to focus on growing their businesses rather than getting bogged down in administrative tasks.

Source: useamp.com

Understanding the features and benefits of these tools is crucial for maintaining compliance and avoiding costly penalties.

Effective ecommerce sales tax software offers features such as automated tax rate calculations based on customer location, real-time tax updates to reflect changing regulations, and streamlined reporting capabilities for various tax jurisdictions. Integration with existing ecommerce platforms is also a key consideration, ensuring seamless data flow and minimizing manual data entry. Choosing the right software depends on factors like business size, sales volume, and the number of states in which the business operates.

Source: geekflare.com

Navigating the complex world of sales tax can be a daunting task for ecommerce businesses, especially as they expand across state lines. Failure to comply with sales tax regulations can lead to significant penalties and legal issues. This is where ecommerce sales tax software steps in, providing a streamlined solution to automate tax calculations, filing, and compliance. This detailed guide explores the intricacies of ecommerce sales tax software, its benefits, key features, and how to choose the right solution for your business.

Understanding the Nuances of Ecommerce Sales Tax

Before delving into the specifics of software, it’s crucial to understand the fundamental principles of sales tax in the ecommerce landscape. Sales tax is a consumption tax levied on the sale of goods and services. The complexity arises from the varying tax rates and regulations across different states, counties, and even cities. The “nexus” concept is paramount; it refers to the connection a business must have with a state to be required to collect sales tax.

This nexus can be established through physical presence (e.g., a warehouse), economic nexus (e.g., exceeding a certain sales threshold within a state), or click-through nexus (though the legality of this is contested and varies by state). Understanding these nuances is critical for accurate tax calculation and compliance.

Key Aspects of Sales Tax Compliance for Ecommerce Businesses, Ecommerce sales tax software

- Determining Nexus: Identifying which states your business has nexus with is the first step. This involves analyzing your sales data and understanding the specific rules of each state.

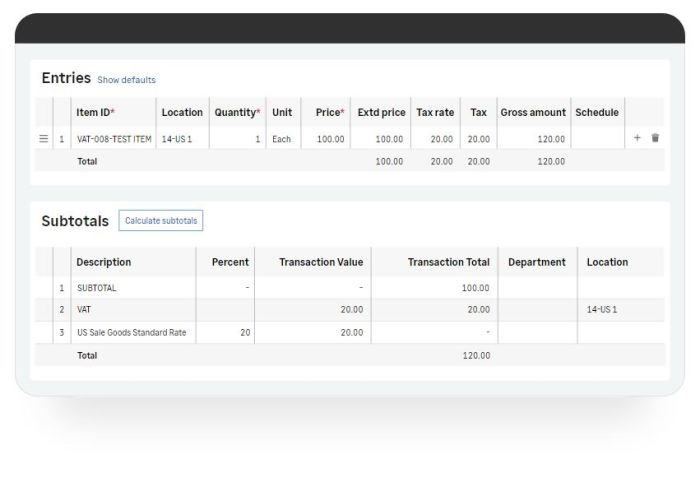

- Tax Rate Calculation: Accurately calculating the applicable sales tax rate for each transaction, considering variations based on location and product type, is essential.

- Sales Tax Reporting and Filing: Each state has its own reporting requirements and deadlines. Failing to file accurately and on time can result in penalties.

- Managing Tax Exempt Sales: Handling tax-exempt transactions, such as those made by government entities or non-profit organizations, requires careful tracking and documentation.

- Staying Updated on Tax Law Changes: Sales tax laws are frequently updated. Staying informed about these changes is vital for ongoing compliance.

The Benefits of Using Ecommerce Sales Tax Software

Ecommerce sales tax software offers numerous advantages over manual tax calculation and filing. These include:

- Automation: Automates the calculation of sales tax based on the customer’s location and product type, eliminating manual errors.

- Accuracy: Reduces the risk of human error in tax calculations, ensuring compliance with state regulations.

- Efficiency: Streamlines the entire sales tax process, saving time and resources.

- Compliance: Helps businesses stay compliant with ever-changing sales tax laws and regulations.

- Reduced Risk of Penalties: Minimizes the risk of penalties and legal issues associated with sales tax non-compliance.

- Integration: Many software solutions integrate seamlessly with popular ecommerce platforms like Shopify, WooCommerce, and Magento.

- Reporting and Analytics: Provides comprehensive reports and analytics on sales tax data, facilitating better financial management.

Key Features of Effective Ecommerce Sales Tax Software

When choosing ecommerce sales tax software, look for these essential features:

- Nexus Determination: The software should automatically determine nexus based on sales data and state regulations.

- Accurate Tax Rate Calculation: It must accurately calculate tax rates considering location, product type, and any applicable exemptions.

- Automated Tax Filing: The software should automate the filing of sales tax returns, reducing manual effort.

- Real-time Tax Calculation: Real-time calculation ensures accurate tax is charged at the point of sale.

- Integration with Ecommerce Platforms: Seamless integration with your existing ecommerce platform is crucial for efficiency.

- Sales Tax Reporting and Analytics: Comprehensive reports and analytics are essential for monitoring tax liabilities and financial performance.

- Customer Support: Reliable customer support is essential for addressing any issues or questions.

- Regular Updates: The software should be regularly updated to reflect changes in sales tax laws and regulations.

Choosing the Right Ecommerce Sales Tax Software

Selecting the appropriate software depends on several factors, including the size of your business, your sales volume, the number of states you operate in, and your budget. Consider these factors when making your decision:

- Scalability: Choose software that can scale with your business growth.

- Ease of Use: The software should be user-friendly and easy to navigate.

- Pricing: Compare pricing plans and features to find the best value for your money.

- Customer Support: Reliable customer support is crucial for addressing any issues or questions.

- Integrations: Ensure the software integrates with your existing ecommerce platform and other business tools.

Frequently Asked Questions (FAQ)

Q: Do I need sales tax software if I only sell in one state?

Source: co.za

A: Even if you only sell in one state, sales tax software can simplify the process of calculating and filing your returns, ensuring accuracy and compliance.

Q: How much does ecommerce sales tax software cost?

A: Pricing varies depending on the features, scalability, and provider. Expect to find options ranging from affordable monthly subscriptions to more enterprise-level solutions with higher costs.

Q: Can sales tax software integrate with my existing accounting software?

A: Many sales tax software solutions offer integrations with popular accounting software, streamlining your financial management.

Q: What happens if I don’t comply with sales tax laws?

A: Non-compliance can result in significant penalties, including fines, interest charges, and even legal action.

Q: How often do I need to file sales tax returns?

A: Filing frequency varies by state. Some states require monthly filing, while others may allow quarterly or annual filing.

Conclusion

Ecommerce sales tax software is an indispensable tool for businesses operating online. It simplifies a complex process, ensuring compliance, minimizing risk, and saving valuable time and resources. By carefully considering your needs and choosing the right software, you can effectively manage your sales tax obligations and focus on growing your business.

References

While specific software recommendations are avoided to remain unbiased, reliable information on sales tax laws can be found on the websites of individual state tax departments and the following resources:

- Internal Revenue Service (IRS)

- Tax Policy Center

- (Add links to other relevant state tax department websites as needed)

Call to Action

Ready to simplify your ecommerce sales tax compliance? Explore different sales tax software options and choose the solution that best fits your business needs. Don’t let sales tax compliance become a burden – take control and streamline your process today!

Ultimately, investing in robust ecommerce sales tax software is a strategic move for any online business. By automating tax processes and ensuring compliance, businesses can minimize financial risks, improve operational efficiency, and dedicate more time and energy to core business functions – leading to increased profitability and growth. The long-term benefits of accurate tax management far outweigh the initial investment, offering peace of mind and a solid foundation for sustainable success in the competitive world of e-commerce.

Top FAQs

What happens if my ecommerce sales tax software malfunctions?

Most reputable software providers offer customer support to help troubleshoot issues. It’s crucial to choose a provider with readily available support channels.

Can I use the same ecommerce sales tax software across multiple online stores?

This depends on the software’s capabilities and your specific needs. Some software can handle multiple stores, while others may require separate licenses.

How do I ensure my chosen software is compliant with current tax laws?

Look for software that automatically updates its tax rates and regulations. Reputable providers actively monitor changes in tax laws.

What types of reports can ecommerce sales tax software generate?

Typically, these reports include sales tax summaries by state, transaction details, and reports suitable for filing with tax authorities.