Sales use tax software sets the stage for efficient tax compliance. Navigating the complexities of sales and use tax can be daunting for businesses of all sizes. However, with the right software, businesses can automate many aspects of tax calculation, reporting, and remittance, significantly reducing administrative burdens and minimizing the risk of penalties. This allows businesses to focus on core operations while maintaining compliance with often-confusing state and local regulations.

The software’s features typically include automated tax rate calculations based on location, product type, and exemption status. Many programs integrate with accounting software for seamless data transfer and reporting, further streamlining the process. Real-time updates ensure that businesses always utilize the most current tax rates, avoiding costly errors. This technology offers a substantial improvement over manual calculation methods, providing accuracy and efficiency.

Navigating the complex world of sales and use tax can be a daunting task for businesses of all sizes. The ever-changing regulations, varying state requirements, and the potential for costly penalties make accurate and timely tax compliance crucial. This is where sales use tax software steps in, offering a powerful solution to simplify this intricate process and minimize risk.

This detailed guide explores the benefits, features, and considerations of implementing sales use tax software for your business.

Understanding Sales and Use Tax

Before delving into the specifics of software solutions, let’s clarify the distinction between sales and use tax. Sales tax is levied on the sale of tangible personal property and certain services within a state. Use tax, on the other hand, is imposed on the use, storage, or consumption of tangible personal property purchased from out-of-state vendors where sales tax wasn’t collected.

Understanding this difference is fundamental to accurate tax calculation and reporting.

Key Considerations for Sales and Use Tax Compliance

- Nexus: Establishing nexus, or a significant connection, with a state triggers the obligation to collect sales tax in that state. This connection can be physical (e.g., a physical presence) or economic (e.g., exceeding a certain sales threshold). The rules surrounding nexus are constantly evolving, adding to the complexity.

- Tax Rates: Sales tax rates vary significantly across states and even within localities. Keeping track of these varying rates is a major challenge for businesses operating in multiple jurisdictions.

- Exemptions: Certain goods and services are exempt from sales tax. Understanding and correctly applying these exemptions is crucial to avoid errors and potential audits.

- Reporting Requirements: Each state has its own unique reporting requirements, deadlines, and filing methods. Failure to comply with these requirements can result in significant penalties.

The Benefits of Sales Use Tax Software

Sales use tax software automates many of the complex tasks associated with sales tax compliance, offering numerous advantages:

Improved Accuracy

Manual sales tax calculations are prone to errors. Software automates this process, ensuring accurate tax calculations based on real-time tax rates and rules. This reduces the risk of penalties and audits.

Time Savings

Automating tax calculations and reporting frees up valuable time and resources that can be allocated to other business-critical tasks. This improves overall efficiency and productivity.

Reduced Costs

While there’s an initial investment in software, the long-term cost savings from reduced errors, penalties, and audit fees often outweigh the expense. The software’s automation capabilities contribute to significant cost reduction in the long run.

Enhanced Compliance

Staying compliant with ever-changing tax laws can be challenging. Many sales use tax software solutions provide updates and notifications about changes in tax rates and regulations, ensuring your business remains compliant.

Better Data Management

Software solutions offer centralized data storage and management, providing a clear and comprehensive overview of your sales tax data. This simplifies reporting and auditing processes.

Key Features of Sales Use Tax Software

Effective sales use tax software should incorporate several key features:

Tax Rate Calculation and Automation

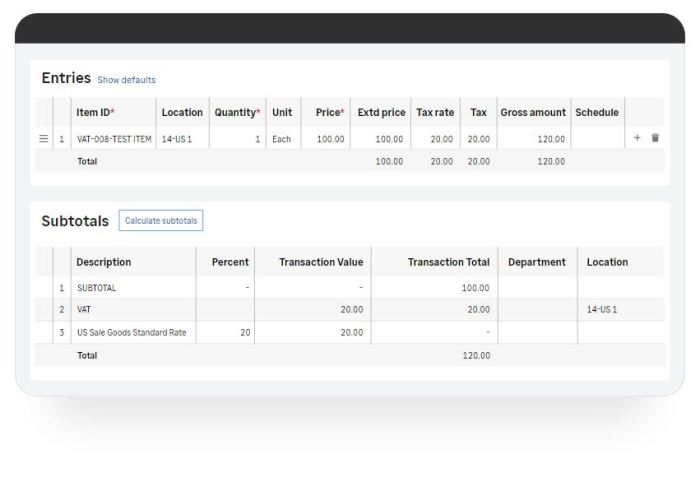

The software should automatically calculate sales tax based on the customer’s location, the product or service sold, and the applicable tax rates. This eliminates manual calculations and minimizes errors.

Nexus Management

The software should help businesses manage their nexus in different states, tracking sales thresholds and ensuring compliance with state-specific regulations.

Exemption Management

The software should allow for easy management of tax exemptions, enabling businesses to apply the correct exemptions to specific transactions.

Reporting and Filing, Sales use tax software

The software should automate the generation of sales tax reports and facilitate the electronic filing of returns to various state tax authorities. This streamlines the reporting process and reduces administrative burden.

Integration with Other Systems

Ideally, the software should integrate with existing accounting and e-commerce platforms, streamlining data flow and reducing manual data entry.

Source: co.za

Audit Trail and Data Security

A robust audit trail and strong data security measures are essential to ensure data integrity and compliance with regulatory requirements.

Choosing the Right Sales Use Tax Software

Selecting the right software involves considering several factors:

Business Size and Complexity

The needs of a small business will differ significantly from those of a large enterprise with complex operations across multiple states.

Integration Capabilities

Ensure the software integrates seamlessly with your existing accounting and e-commerce systems.

Pricing and Support

Compare pricing models and ensure adequate customer support is available.

Scalability

Choose software that can scale with your business’s growth.

Frequently Asked Questions (FAQ)

- Q: What is the difference between sales tax and use tax?

A: Sales tax is levied on sales within a state, while use tax applies to purchases from out-of-state vendors where sales tax wasn’t collected. - Q: What is nexus?

A: Nexus is a significant connection with a state that triggers the obligation to collect sales tax. - Q: How can sales use tax software help my business?

A: It automates tax calculations, reduces errors, saves time, and ensures compliance. - Q: What features should I look for in sales use tax software?

A: Tax rate calculation, nexus management, exemption management, reporting and filing capabilities, and integration with other systems are crucial. - Q: How much does sales use tax software cost?

A: Pricing varies depending on the vendor, features, and business size. It’s best to obtain quotes from multiple providers.

Resources

- Internal Revenue Service (IRS)

- Tax Foundation

- (Add links to reputable sales tax software providers here)

Conclusion

Implementing sales use tax software is a strategic decision that can significantly benefit businesses of all sizes. By automating complex tax calculations, streamlining reporting, and ensuring compliance, this software empowers businesses to focus on growth and profitability while minimizing the risks associated with sales and use tax. Choosing the right software requires careful consideration of your business’s specific needs and requirements.

Take the time to research available options and select a solution that aligns with your long-term goals.

Call to Action

Ready to simplify your sales tax compliance and reclaim valuable time and resources? Contact us today for a free consultation and let us help you find the perfect sales use tax software solution for your business!

Ultimately, the adoption of sales use tax software represents a strategic move towards improved financial management and compliance. By automating complex tasks and ensuring accuracy, businesses can gain a significant competitive advantage. The benefits extend beyond simple cost savings; they encompass enhanced efficiency, reduced risk, and improved overall financial health. Investing in such software is a demonstrable commitment to responsible business practices and long-term success.

Q&A

What types of businesses benefit most from sales use tax software?

Source: wolterskluwer.com

Businesses with high sales volumes, those operating in multiple states, or those selling taxable goods and services online generally benefit most. Even small businesses can find significant advantages in terms of time savings and accuracy.

Source: rahulogy.com

How much does sales use tax software typically cost?

Pricing varies considerably depending on the features, scale, and provider. Expect a range from subscription-based monthly fees to one-time purchases, with costs influenced by the number of users and transactions.

Is sales use tax software difficult to learn and use?

Most reputable software providers offer user-friendly interfaces and training resources. The learning curve depends on the complexity of the chosen software and the user’s prior experience with similar programs. Many offer excellent customer support to assist with implementation and ongoing use.

Can sales use tax software integrate with my existing accounting software?

Many programs offer seamless integration with popular accounting platforms. Check the software’s compatibility before purchasing to ensure it works with your current systems.