Sage Software for Accountants simplifies complex accounting tasks, empowering professionals to manage finances efficiently. This powerful software suite offers a range of features designed to improve accuracy, reduce errors, and ultimately save time. From invoicing and expense tracking to financial reporting and tax preparation, Sage provides a comprehensive solution for accounting firms and businesses of all sizes. Its intuitive interface and robust functionalities make it a popular choice among accountants seeking to optimize their workflows and enhance client service.

The software’s adaptability allows for customization to meet specific business needs, offering various modules and integrations to cater to diverse accounting practices. Features like automated data entry, real-time reporting, and cloud-based accessibility contribute to a more streamlined and efficient accounting process. Furthermore, Sage’s commitment to ongoing updates ensures that the software remains current with evolving accounting standards and regulations.

Sage accounting software has become a mainstay for accounting professionals and businesses of all sizes. Its robust features, scalability, and user-friendly interface have cemented its position as a leading player in the accounting software market. This comprehensive guide delves into the various aspects of Sage software, exploring its capabilities, benefits, and considerations for accountants.

Understanding Sage Accounting Software

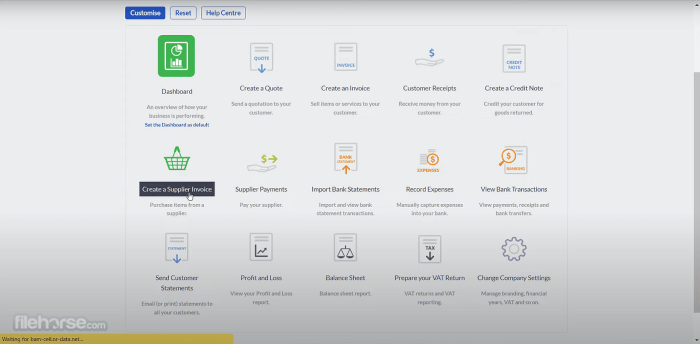

Sage offers a range of accounting software solutions tailored to different business needs, from small startups to large enterprises. These solutions typically include features like:

Core Features of Sage Accounting Software:

- Invoicing and Billing: Create and send professional invoices, track payments, and manage outstanding balances efficiently. Sage often integrates with various payment gateways for streamlined processing.

- Accounts Payable and Receivable: Manage vendor payments, track outstanding invoices from clients, and maintain accurate records of financial transactions.

- General Ledger: Maintain a comprehensive record of all financial transactions, ensuring accuracy and compliance with accounting standards.

- Financial Reporting: Generate various financial reports, including profit and loss statements, balance sheets, and cash flow statements, providing valuable insights into business performance. Customizable reports are often a key feature.

- Inventory Management: Track inventory levels, manage stock, and optimize ordering processes (particularly relevant in Sage solutions designed for businesses with inventory).

- Payroll Management: Process payroll, manage employee information, and ensure compliance with tax regulations (often a separate module or integrated feature depending on the Sage product).

- Bank Reconciliation: Reconcile bank statements with accounting records to ensure accuracy and identify discrepancies.

- Budgeting and Forecasting: Create budgets, track expenses against budget targets, and forecast future financial performance.

- Customer Relationship Management (CRM) Integration: Many Sage solutions offer integration with CRM systems, allowing for a holistic view of customer interactions and financial data.

Choosing the Right Sage Software for Your Needs

Sage offers a diverse portfolio of accounting software solutions. The best choice depends on factors such as business size, industry, specific needs, and budget. Some popular options include:

Popular Sage Accounting Software Solutions:

- Sage 50cloud Accounting: A popular choice for small and medium-sized businesses, offering a comprehensive suite of accounting features in a user-friendly interface.

- Sage Intacct: A cloud-based accounting solution designed for mid-market and enterprise businesses, providing advanced functionality and scalability.

- Sage 300cloud: A comprehensive ERP (Enterprise Resource Planning) solution for larger businesses, integrating accounting with other business functions like manufacturing, distribution, and project management.

- Sage Business Cloud X3: Another ERP solution, suited for larger, multinational companies requiring robust global capabilities.

It’s crucial to carefully evaluate your business requirements and explore the features of each Sage product before making a decision. Many offer free trials or demos to allow for thorough testing.

Benefits of Using Sage Accounting Software

Implementing Sage accounting software offers numerous benefits for accountants and their clients:

Advantages of Sage for Accountants and Businesses:, Sage software for accountants

- Improved Accuracy: Automated processes and robust data validation minimize errors and ensure accurate financial records.

- Increased Efficiency: Streamlined workflows and automated tasks free up time for more strategic activities.

- Enhanced Productivity: Access to real-time data and insightful reports allows for quicker decision-making.

- Better Collaboration: Cloud-based solutions enable seamless collaboration among team members and clients.

- Improved Compliance: Built-in features help ensure compliance with relevant accounting standards and tax regulations.

- Scalability: Sage offers solutions that can grow with your business, adapting to changing needs.

- Cost Savings: Automation and improved efficiency can lead to significant cost savings in the long run.

- Data Security: Reputable providers like Sage prioritize data security with robust measures to protect sensitive financial information.

Considerations When Implementing Sage Software

While Sage offers numerous benefits, it’s essential to consider certain factors before implementation:

Factors to Consider Before Implementing Sage:

- Cost: Sage software solutions vary in price, depending on the chosen product and features. Consider the total cost of ownership, including licensing fees, implementation costs, and ongoing support.

- Training: Adequate training is essential to ensure users can effectively utilize the software’s features. Sage often provides training resources and support.

- Integration: Ensure the chosen Sage solution integrates seamlessly with other business systems, such as CRM and payroll software.

- Support: Reliable customer support is crucial for resolving issues and receiving assistance when needed. Sage typically offers various support options.

- Data Migration: Migrating data from existing systems to Sage can be complex. Plan carefully and consider professional assistance if necessary.

Frequently Asked Questions (FAQ)

- Q: Is Sage accounting software suitable for small businesses? A: Yes, Sage offers various solutions tailored to small businesses, such as Sage 50cloud Accounting, providing essential accounting features without unnecessary complexity.

- Q: What is the cost of Sage accounting software? A: The cost varies depending on the specific product and features chosen. It’s best to contact Sage directly or a reseller for pricing information.

- Q: How does Sage software ensure data security? A: Sage employs robust security measures, including data encryption, access controls, and regular security updates, to protect sensitive financial information.

- Q: Does Sage offer cloud-based solutions? A: Yes, Sage offers several cloud-based accounting solutions, providing accessibility and collaboration benefits.

- Q: What kind of support does Sage provide? A: Sage typically offers various support options, including phone support, online resources, and training materials.

- Q: Can I integrate Sage with other software? A: Sage offers integration capabilities with various other business systems, such as CRM and payroll software. The specific integrations available depend on the chosen Sage product.

Conclusion

Sage accounting software offers a comprehensive and versatile solution for accountants and businesses of all sizes. By carefully considering your needs and exploring the various options available, you can find the right Sage solution to streamline your accounting processes, improve efficiency, and gain valuable insights into your financial performance.

Call to Action: Sage Software For Accountants

Ready to explore how Sage accounting software can benefit your business? Visit the Sage website today for more information and to request a demo! [Link to Sage Website]

Source: aroundfinance.ie

Ultimately, Sage Software for Accountants presents a compelling solution for professionals seeking to enhance efficiency and accuracy in their accounting practices. By streamlining workflows and providing robust tools for financial management, Sage empowers accountants to focus on strategic advisory services and building stronger client relationships. The software’s adaptability and continuous development ensure its continued relevance in the ever-evolving landscape of accounting technology, making it a valuable asset for businesses and accounting firms alike.

FAQ Insights

What are the different versions of Sage accounting software?

Sage offers various versions tailored to different business sizes and needs, ranging from basic accounting software to enterprise-level solutions. Specific features and pricing vary by version.

Source: filehorse.com

How much does Sage accounting software cost?

Pricing for Sage accounting software varies depending on the specific version, features, and subscription plan chosen. It’s best to contact Sage directly or a reseller for accurate pricing information.

Does Sage integrate with other software?

Yes, Sage integrates with various third-party applications, including CRM systems, payroll software, and e-commerce platforms. The specific integrations available depend on the chosen Sage version.

What kind of training is available for Sage accounting software?

Sage offers various training resources, including online tutorials, webinars, and in-person training sessions, to help users learn how to effectively use the software.

What is Sage’s customer support like?

Sage provides customer support through various channels, including phone, email, and online help resources. The level of support may vary depending on the chosen subscription plan.